2021.05.03

500 Global Team

Credit: iGrow

Credit: iGrowA growth spurt

- 500-backed peer-to-peer (P2P) lending startup iGrow has been acquired by payments company LinkAja in its move to expand into online financing especially for micro, small, and medium enterprises (MSMEs).

- iGrow was founded in 2014, designed at first to give people easy access to invest in agricultural businesses. It eventually transformed into a P2P lending platform.

- “This will accelerate the vision and mission of iGrow to have an impact on MSMEs and can make iGrow one of the main players in the financing sector for the productive sector,” said iGrow chief business development officer Jim Oklahoma.

- Read the full article on KrAsia here.

Credit: Feed Earth Spirit

Credit: Feed Earth SpiritSpurring social change

- Founder of 500-backed review app abillion, Vikas Garg, was interviewed by Feed Earth Spirit, a food and environment media platform.

- The app helps users find vegan options in restaurants, information about packaged food products, sustainable products in beauty, wellness, and even fashion.

- To encourage users to stay active on the app, Vikas said that the platform uses ‘gamification’, the application of gaming elements and principles in non-game contexts. Users who post their first complete review on the app earn US$1 which they can donate to any of the 65 non-profit organizations the startup has partnered with.

- On the other side of the coin, users can ‘poke’ a restaurant to nudge them, for instance, into serving vegan dishes if they don’t offer any. abillion will then send the restaurant targeted information such as the best vegan dishes by its competitors to inspire and drive them to start serving vegan food.

- Watch the full interview on Feed Earth Spirit here.

Credit: e27

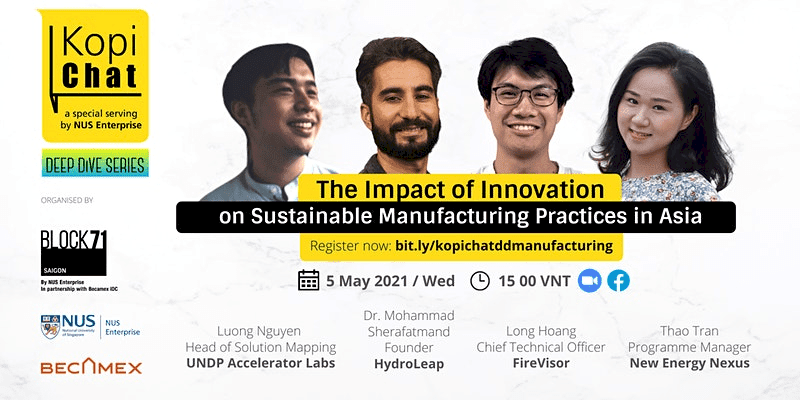

Credit: e27A sustainable path to the future

- Two 500-backed founders will be speaking at an event organized by NUS Enterprise, the entrepreneurial arm of the National University of Singapore (NUS), on the topic “The Impact of Innovation on Sustainable Manufacturing in Asia”.

- One is Dr. Mohammad Sherafatmand, CEO of Hydroleap, a wastewater treatment startup that introduces a cleaner way to treat wastewater.

- The other is Long Hoang, Chief Technical Officer of FireVisor. FireVisor creates self-aware factories that perform engineering failure analysis in real-time.

- This panel discussion will explore how sustainable manufacturing goes hand-in-hand with the United Nations Sustainable Development Goal.

- Register for the 5 May event here.

Missed out the last Daily Markup? Go here to check it out.

You can also find us on LinkedIn, Facebook, Twitter, and Instagram.

500 Startups is a venture capital firm on a mission to discover and back the world’s most talented entrepreneurs, help them create successful companies at scale, and build thriving global ecosystems. In Southeast Asia, 500 Startups invests through the pioneering 500 Southeast Asia family of funds. The 500 Southeast Asia funds have backed over 240 companies across multiple sectors from internet to consumer to deep technology. It continues to connect founders with capital, expertise and powerful regional and global networks to help them succeed.

This post is intended solely for general informational or educational purposes only. 500 Startups Management Company, L.L.C. and its affiliates (collectively “500 Startups”) makes no representation as to the accuracy or information in this post and while reasonable steps have been taken to ensure that the information herein is accurate and up-to-date, no liability can be accepted for any error or omissions. All third party links in this post have not been independently verified by 500 Startups and the inclusion of such links should not be interpreted as an endorsement or confirmation of the content within. Information about portfolio companies’ markets, competitors, performance, and fundraising has been provided by those companies’ founders and has not been independently verified. Under no circumstances should any content in this post be construed as investment, legal, tax or accounting advice by 500 Startups, or an offer to provide any investment advisory service with regard to securities by 500 Startups. No content or information in this post should be construed as an offer to sell or solicitation of interest to purchase any securities advised by 500 Startups. Prospective investors considering an investment into any 500 Startups fund should not consider or construe this content as fund marketing material. The views expressed herein are as at the date of this post and are subject to change without notice. One or more 500 Startups fund may have a financial interest in one or more of the companies discussed.